What’s Up?

Now that we’re more than halfway through 2021, we were thinking about the de rigueur predictions that will soon be coming our way for 2022. For some reason, that put us in mind of the classic Budweiser commercial from 1999. After that, we decided to get serious; although, we really didn’t feel like it.

It’s safe to assume that most of the 2022 predictions for insurance will have to do with technology. The list will, no doubt, include:

- Artificial intelligence (AI). When more and more homes and cars contain voice-activated assistance, the insurance industry will continue to adopt AI as it can, particularly in the interests of personalizing the policyholder experience and the policyholder’s rates. How will AI do that? With …

- Machine learning. Simply put, machine learning is stored data that constitutes acquired experience. Combined with AI, that acquired experience can be analyzed and translated into actionable information and automated processing. And where will all this stored data come from? From …

- The Internet of Things (IoT). Given the connectivity of everything on the Web — including smart-homes gadgets, automobile sensors, wearables, online retail sites, referral-program software, and who knows what — insurers that don’t tap into IoT technology are going to miss the boat and then some.

- Telematics. See AI, machine learning, and IoT.

- Social media. Given the pace at which things evolve, it’s interesting to look at how quickly definitions of things like IoT seem to evolve. They used to focus on hardware devices. Now they include every social-media site imaginable, all of which are tracking us like bloodhounds in the woods or sharks in the water.

Sneak Peeks

Chances are pretty slim that we’ll end up in the fortune-telling business. We’ve been developing insurance technology for so long at this point that a career change might not be the most prudent decision we could make. But you really don’t need powers of prognostication to see what’s coming for the insurance industry, technologically speaking.

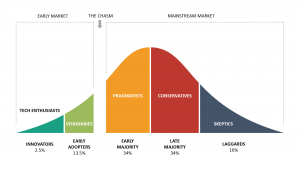

The industry will continue to follow its conservative nature, as it should. It’ll prudently adopt technologies as it can. It’ll wisely heed the needs of its policyholders. It’ll stay a few steps back from leading edges, which is a much safer place to be anyway. But in the end, it’ll come around, as it always does.

That’s what’s up.